Overview

Our client has an innovative platform that streamlines corporate governance by offering secure digital shareholder voting solutions. Prior to this project, their reliance on manual classification of SEC filings was inefficient and limited their ability to scale. Our AI-driven solution was integrated into their backend systems, automating the analysis and categorization of Form 8-K filings related to board meeting resolutions without the need for predefined categories.

The Solution

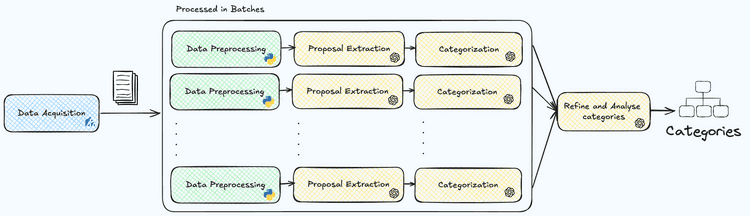

Our team developed a two-module system leveraging AI for both category discovery and proposal classification.

Building Initial Categories Using EDGAR Board Meeting Resolutions

- Data Retrieval: Collected 4,000 Form 8-K filings from the SEC’s EDGAR database using the SEC API.

- Data Processing: Employed BeautifulSoup to extract raw text from HTML files, minimizing token usage in subsequent AI processing.

- Proposal Extraction: Utilized OpenAI’s

gpt-4o-minito extract shareholder proposals from each filing. - Category Discovery: Processed batches of 150 proposals (due to token limits) through

gpt-4o-minito iteratively discover and refine categories. The AI model analyzed the content to uncover inherent topics and organize them into a hierarchical structure.

Generating Categories

Generating the categories is done by using OpenAI’s ChatCompletion API with the gpt-4o-mini model, leveraging function calling to return structured output. This feature allows the model to extract and organize categories from unstructured text. The system and user messages guide the model, with a JSON schema specifying the expected output format. By invoking the chat.completions.create method, the model processes the proposals, dynamically categorizing them based on context. This approach enables flexible and scalable categorization, allowing the AI to analyze and classify text without predefined rules. Here is an example of the resulting categories:

{

"Corporate Governance": [

"Election of Directors",

"Amendments to Corporate Governance",

"Board Structure and Composition",

"Governance and Bylaw Amendments",

"Amendments to Certificate of Incorporation",

"Voting Rights",

"Shareholder Rights and Protections"

],

"Financial Oversight and Capital Structure": [

"Auditor Ratification",

"Capital Structure Adjustments",

"Share Issuances and Authorizations",

"Mergers and Acquisitions",

"Regulatory Compliance"

],

"Compensation and Equity Plans": [

"Executive Compensation",

"Stock Option Plans",

"Equity Plans",

"Employee Stock Purchase Plans"

],

"Strategic Planning and Business Operations": [

"Approval of Business Plans",

"Shareholder Proposals"

],

"Environmental, Social, and Governance (ESG)": [

"Environmental and Sustainability Reporting",

"Corporate Social Responsibility"

]

}Architecture

Our approach to the technical architecture was to create a simple end-to-end system, including everything from data retrieval via the SEC API to proposal extraction, category discovery, and refinement:

Front End: Voting Agenda Query Application

After the categories were generated, we took on the challenge of creating a user interface to demonstrate the capabilities of our solution.

- User Input: Developed a user interface where users can input a stock ticker or company name.

- Data Fetching: The system fetches the latest 8-K filing for the specified company and extracts raw text.

- Proposal Extraction: Uses

gpt-4o-minito extract any proposals that shareholders voted on from the filing. - Proposal Classification: The extracted proposals are categorized based on the AI-discovered categories from the category generation module.

- Output Display: Presents the proposals along with their respective categories in an intuitive format for user review.

The application allows users to search for a public company by name or ticker and then processes real company filings to extract, analyze, and categorize shareholder proposals using OpenAI’s API with the gpt-4o-mini model. Once a company is selected, the program fetches its 8-K filing and uses the AI model to extract relevant proposals. The proposals are then analyzed by the AI, which identifies key aspects and assigns them one of the previously-discovered categories. This interactive application leverages the AI’s natural language understanding to provide an accurate and dynamic categorization of corporate agenda items, offering users a streamlined way to explore and understand the issues up for shareholder voting.

Benefits

- Automated Category Discovery: Enabled the client to uncover inherent patterns and categories within the data without manual intervention.

- Enhanced Efficiency: Automation reduced processing time from hours to minutes, allowing staff to focus on higher-value tasks.

- Scalability: The system can handle increasing volumes of data and adapt to new types of filings or international datasets.

Conclusion

The project transformed the manual approach to handling board meeting resolutions by automating both the discovery of categories and the classification process. Leveraging AI eliminated the need for manual categorization and predefined labels, resulting in a more efficient, accurate, and scalable solution. The client is now better positioned to expand their services, offering quicker insights into corporate governance matters and enhancing their competitive edge.

Read more about our experience with AI.

Do you need an AI expertise at your company?

Check out the AI services we offer and don't hesitate to contact us for a free consultation.