Overview

Car insurance companies and brokers are responsible for managing large volumes of policy documents, typically in unstructured or semi-structured formats. Extracting key details such as policyholder information, coverage specifics, and exclusions can be slow and costly, often requiring extensive training and experience.

This is where our client seizes the opportunity and reaches us to build a solution for maximizing operational efficiency for insurance brokers and companies.

In response, together we developed a secure solution that leverages large language models (LLMs) to automate the extraction process, converting the data into a structured JSON format. The system is tailored to handle varying volumes and complexities of policies, providing flexibility in cost and performance depending on the client's specific needs.

R&D

The research and development phase of this solution focused on evaluating different LLMs for performance, accuracy, and cost-efficiency. A key requirement was ensuring that the client's data remained within the secure environment, meaning third-party services that required external data handling were not an option. This necessitated using models available via AWS Bedrock API, ensuring all processing was handled privately and securely.

We tested three models extensively to determine their suitability for different scenarios:

- Llama 3.1 70B: At a processing cost of $0.011 per policy*, this model provided a cost-effective solution for high-volume scenarios. While not as detailed as other models, it delivered acceptable accuracy for most standard policies, making it ideal for cost-conscious clients.

- Mistral Large 2: This model, costing $0.026 per policy*, offered more detailed and precise extraction, especially for policies that contained complex coverage terms or numerous exclusions. It provided highly accurate JSON output for intricate policies. Though more expensive, it was the preferred choice where accuracy and completeness were critical.

- Claude 3.5 Sonnet performed almost as well as Mistral Large 2, but its cost-to-value ration didn't look that appealing - $0.045 per policy*.

* $x.xx per policy: a single policy has average size of 4 pages, which translates to about 10,000 input tokens and around 1,000 output tokens for the structured JSON. The costs mentioned above are based on pricing available at the time this case study is published (October 2024).

The Solution

Our solution automates the extraction of key information from car insurance policies and outputs the data in a structured JSON format. It includes the following key elements:

- Flexible Model Use: Depending on the policy volume and detail required, users can select between two models:

- Basic for high-volume, lower-cost processing at $0.011 per policy.

- Advanced for more detailed and precise data extraction at $0.026 per policy.

- Data Security: All processing is conducted in a secure environment where none of the policies are exposed to the public internet, ensuring compliance with strict data privacy regulations.

- Cost Efficiency: By allowing the selection of models based on specific needs, companies can optimize costs while maintaining performance. For instance, a company processing 100,000 policies could save $1,500 using the "Basic" model over the "Advanced", while still achieving adequate results for standard policies.

- High Accuracy for Complex Cases: In more complex cases, such as policies with many coverages or exclusions, the "Advanced" model ensures nothing is missed, making it worth the additional cost for these scenarios.

Technical Overview

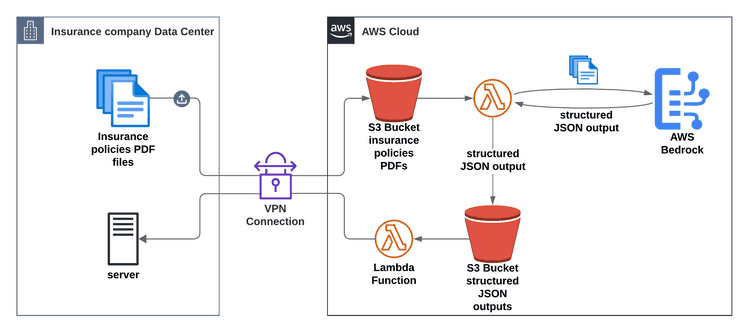

The solution is designed to be flexible and easy to integrate into existing systems. It utilizes AWS Lambda, S3 event notifications, and AWS Bedrock, and offers a fully automated and serverless architecture, making it cost-effective, secure, and easy to scale based on client needs. Here’s a high-level overview of how clients would consume this solution:

-

File Upload: Clients upload car insurance policies in PDF format to a dedicated AWS S3 bucket.

-

Triggering the Processing: Once a file is uploaded, an S3 event automatically triggers the processing workflow.

-

Model Selection: Depending on the client’s preferences and specific needs (high-volume, low-cost vs. detailed extraction), the appropriate LLM model is selected to process the policy, derived from a default config or per-filename overrides convention.

-

Extraction and JSON Output: The selected model extracts critical information from the policy, converting it into a structured JSON format based on the predefined schema.

-

Storage of Results: The structured JSON file is saved in the same AWS S3 bucket or a different one specified by the client, making the data easily accessible for downstream use (e.g., claims processing, and policy reviews).

-

Integration Flexibility: Clients can further integrate this solution with their internal systems by directly accessing the JSON output, feeding it into their databases or other applications by subscribing to the respective AWS S3 events. This architecture allows for flexibility and scalability, ensuring that the solution fits seamlessly into different workflows.

With this setup, clients maintain control over their data within the secure AWS environment, ensuring compliance with data privacy regulations. The use of AWS S3 keeps the infrastructure lightweight, cost-effective, and highly adaptable.

JSON Output ("Advanced"):

{

"insurance_type": "Comprehensive Motor Insurance",

"insurance_number": "1234X5678901",

"insurance_provider": {

"name": "Insurance Joint Stock Company 'Insurance' JSC",

"tax_id": "123456789",

"bulstat": "123456789"

},

"policy_holder": {

"name": "John Doe",

"personal_id": 1234567890,

"address": "Sofia, Vitosha, Building 1, Entrance A, Floor 1, Apartment 1"

},

"vehicle": {

"registration_number": "AA1234BB",

"VIN": "1HGCM82633A123456",

"category": "Passenger Car",

"brand": "MAZDA 6",

"color": null

},

"coverage_period": {

"start": "2024-10-09T00:00:00",

"end": "2025-10-08T23:59:00"

},

"insured_amount": 10500.0,

"premium": {

"total_due": 883.58,

"base_premium": 866.25,

"tax": 17.33,

"fees": 0.0

},

"territorial_coverage": [

"Republic of Bulgaria",

"countries that are members of the Green Card system",

"European Union"

],

"coverages": [

"Natural disasters (storm, hurricane, hail, flood due to natural disaster, and others)",

"Fire and/or explosion due to the above-mentioned natural disasters, as well as technical malfunction or other accidental events, excluding intentional arson or intentionally caused explosion",

"Traffic accidents (including damage to the insured vehicle while parked, caused by another vehicle or animal; impact from a stone or other object thrown during the movement of another vehicle)",

"Accidental falling of objects or liquids from buildings, aircraft, or parts of them",

"Damage to the insured vehicle due to a failure in plumbing, sewage, steam, or sprinkler systems in a garage or parking lot where it was parked",

"Theft of the entire vehicle",

"Robbery of the entire vehicle",

"Unauthorized taking of the entire vehicle with the intent of using it",

"Theft via burglary or technical means of permanently factory-installed multimedia equipment, including audio, video, and/or navigation systems",

"Malicious actions by third parties",

"Intentional arson or intentionally caused explosion of the vehicle"

],

"exclusions": [

"Damage resulting from technical malfunction",

"Missing individual parts, equipment, accessories, fuel, and oils",

"Missing or damaged personal belongings inside the vehicle",

"Depreciation, lost profits, penalties, and other indirect damages",

"Any damage to vehicle parts that was found during the insurance of the vehicle",

"Damages occurring while the vehicle was operated by a driver without a valid driver's license",

"Damages occurring while the vehicle was operated by a driver under the influence of alcohol and/or drugs",

"Damages caused by intentional or grossly negligent actions of the insured or persons using the vehicle",

"Damages resulting from gross violation of vehicle operating rules",

"Damages during use of the vehicle outside the regulated road network or in areas with increased risk of damage",

"Other damages and cases described in detail in the General Terms and Conditions for Comprehensive Motor Insurance"

],

"limitations": [

"Only damages occurring within the insurance coverage period are covered",

"Insurance coverage does not start until the obligations for vehicle inspection and photography",

"Comprehensive motor insurance is issued for an insured amount that cannot exceed the actual value of the vehicle on the date specified in the policy for the start of coverage. The insured amount is the limit of the insurer's liability",

"Coverage is limited to the risks and exclusions described in detail in the General and Special Terms and Conditions of the Comprehensive Motor Insurance"

],

"payment_method": "One-time"

}Impact

The flexibility of this solution has a significant economic impact on car insurance companies:

- Cost Optimization: Insurance companies handling large volumes of policies can significantly reduce their processing costs by selecting the "Basic" model for standard tasks while reserving the "Advanced" for more complex policies. This tailored approach can reduce operational costs, depending on the policy mix.

- Increased Efficiency: Automation reduces manual effort, speeding up policy processing times by 80%, enabling teams to focus on higher-value tasks such as customer service or risk assessment.

- Improved Accuracy: By using advanced LLMs, companies can eliminate human error, resulting in cleaner, more reliable data for downstream tasks such as claims processing, risk analysis, and customer retention efforts.

Conclusion

Our LLM-powered solution offers a versatile, secure, and cost-effective approach to automating car insurance policy data extraction. Whether a company prioritizes volume or precision, this solution provides the flexibility to adapt to their needs while maintaining data security. With clear cost advantages for high-volume tasks and enhanced accuracy for more detailed policies, this tool is a game-changer in automating insurance workflows.

Do you need AI expertise at your company?

Check out the AI services we offer and don't hesitate to contact us for a free consultation.